Calculating climate financial risk: How to combine transition and physical risks?

Source: www.427.com

Climate financial risks depend on climate pathways

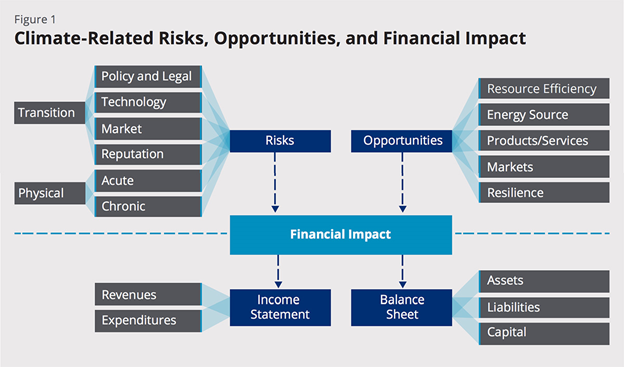

Climate change has implications for our real economy as well as the financial sector. Depending on which climate pathway we eventually end up on, economic actors — businesses, investors, governments — are likely to face financial risks,[1] transition and physical, commonly labeled as climate financial risks or simply climate risks.

To understand these risks, we need to first understand potential climate pathways,[2] also known as transition pathways. If we continue to emit carbon as usual, we are likely to be on an approximate 5C global warming to year 2100 pathway,[3] also known as the business-as-usual (BAU) pathway.[4] On the other hand, if we act via climate friendly policies, we may end up on different pathways to different temperature targets to 2100, such as 1.5C, 2C, 3C, or 4C, among others. For example, the 2C aspirational target was agreed on in the UNFCCC’s Paris COP in 2015 and was subsequently revised to 1.5C.[5] However, the declared intended actions by participant countries at the Paris COP, also known as the nationally determined contributions (INDCs), are likely to land us on the 3C pathway, and not on the 2C pathway, as targeted by the Paris COP.[6]

Depending on the pathway we are currently on (i.e., BAU) and the pathway we may end up on due to future policy action (e.g., 2C), an economic actor may face transition as well as physical risks, each typically measured as Value at Risk (VaR),[7] which essentially translates to economic value — in net present value terms — being lost compared to a pathway that does not take climate change into account at al. An example of the latter is when value is being calculated using forecasts that ignore impacts of climate change in the future.[8]

Climate financial risks are sum of transition and (residual) physical risks

In this context, focusing on the 2C pathway, provided the world switches from the BAU pathway to the 2C pathway, transition risk is the VaR due to policy, market, and technology changes — e.g., a higher carbon tax.[9] On the other hand, physical risk is the VaR due to climate impacts — e.g., higher supply chain (disruption) costs due to more severe storms — at the 2C pathway compared to the current state which ignores climate change.[10]

Then, total climate financial risk on the 2C pathway is the sum of transition risk (from the BAU pathway to the 2C pathway) and physical risk (at the 2C pathway). That is, on any climate pathway (e.g., the 2C pathway), transition and physical risks cannot be calculated independently of each other. In fact, they are not only conditional on the eventual climate pathway that we land up on but also are constituent parts of the total climate financial risk.

Furthermore, given the sequence described above, we need to calculate transition risk first (from the BAU pathway to the 2C pathway), followed by physical risk (at the 2C pathway). That is, physical risk is the residual climate financial risk after the transition risk has been evaluated. In other words, physical risk is the risk that remains after transition risk has been measured. This distinction is frequently missed in calculation of climate financial risk, e.g., in MSCI’s approach to climate VaR, which treats transition and physical risks independently of each other.[11]

Policy has central role in determining (uncertain) climate risk

This brings up the importance of policy. Climate policy — in the simplest form, a carbon tax[12] — would determine which climate pathway we will eventually end up on.[13] In fact, given that climate policy would drive and influence markets (e.g., demand pull for renewable energy) as well as technology development (e.g., supply push for green hydrogen), climate policy is the starting point for any climate pathway that we expect to eventually land up on.

This also brings up the impact of policy uncertainty in calculating climate financial risk.[14] From the BAU pathway, given climate policy action, we can land up on any other climate pathway. Each of these pathways (e.g., the 2C pathway) would have associated probability of occurrence as well as impact, where the latter is the sum of VaRs from transition (from the BAU pathway to the 2C pathway) and physical (at the 2C pathway) risks. For example, today the probabilities of the 1.5C, 2C, 3C, 4C pathways could be 0.1, 0.2, 0.3, 0.4, respectively. The expected climate financial risk then is the probability weighted average of impacts on these pathways.

In practice, however, these probabilities have been pretty much ignored, primarily because of the uncertainties about the probabilities themselves. This uncertainty about the underlying models is called ambiguity,[15] and has become an area of research.[16] While there have been attempts to estimate these probabilities, e.g., of the carbon tax representation,[17] a scenario (i.e., pathway)-based analysis, which remains the current focus, may also prove instructive in the inter

[1] See Federal Reserve Bank of San Francisco | Climate Change Is a Source of Financial Risk (frbsf.org)

[2] See Climate Action Pathways | UNFCCC

[3] This is in comparison to pre-industrial times.

[4] See RCP 8.5: Business-as-usual or a worst-case scenario? | Climate Nexus

[5] See Paris Climate Agreement: Everything You Need to Know | NRDC

[6] See Analysis: Which countries met the UN’s 2020 deadline to raise ‘climate ambition’? — Resilience

[7] See Scenario Analysis — MSCI. Note that VaR is mostly from a valuation (or equity) perspective. Debtholders may care about impact on credit ratings, which themselves depend on cashflows that are used to calculated VaR.

[8] See Climate risks to business: why there are more than you think | World Economic Forum (weforum.org)

[9] See cisl-climate-wise-transition-risk-framework-report.pdf (cam.ac.uk)

[10][10] See Physical risk framework: Understanding the impact of climate change on real estate lending and investment portfolios — Cambridge Institute for Sustainability Leadership

[11] See Climate Value-at-Risk (msci.com)

[12] See Carbon tax most powerful way to combat climate change: IMF (cnbc.com)

[13] See https://energypolicy.columbia.edu/sites/default/files/pictures/CGEP_Energy_Environmental_Impacts_CarbonTax_FINAL.pdf

[14] See Paper-9–2019–11–8-Fried-420PM-1st-paper.pdf (frbsf.org)

[15] See Scientific Ambiguity and Climate Policy.pdf (columbia.edu)

[16] See New Preliminary Paper: “Confronting Uncertainty in the Climate Change Dynamics” — Lars Peter Hansen

[17] See Climate-Change-Investment-Risks-Optimal-Portfolios-Executive-Summary-1.pdf (ipe.com)